Your welcome to expand the collapsed cells to dig into the underlying calculations. In April of 2021, you’ll get your income – tax liability returned to you in the form of a massive tax refund….the largest of your life.

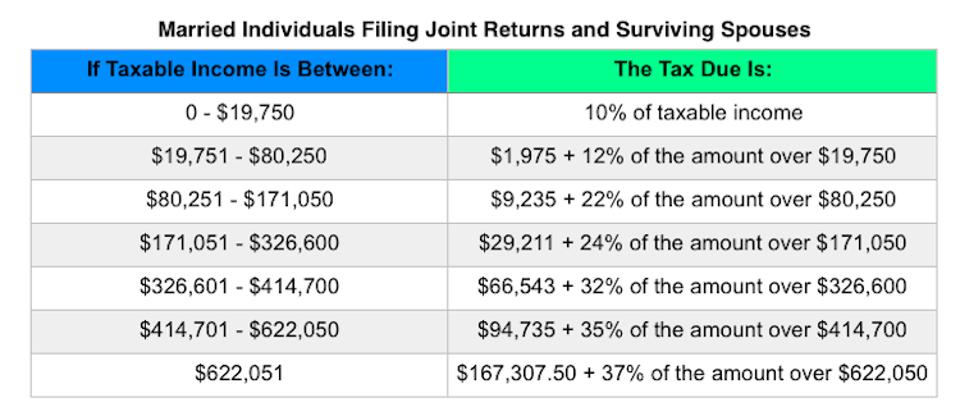

If you made $100k gross but contributed $19.5k to a Trad 401k, paid $12k in healthcare premiums, and contributed $7,200 to an HSA, then your taxable income is $61,300 (=100k-19.5k-12k-7.2k).

Effective marginal tax rates for $1 extra labor income.Standard vs Itemized deductions (including $10k SALT cap).Single, Head of Household ( new this year!), Married.Stuff my spreadsheet handles (or attempts to): With a 2% dividend yield, this implies that one could qualify for the EITC with $500k of taxable investment balances.Investment income threshold was increased from $3,650 to $10k!.For those with high enough incomes, it reverts to the same $2k/kid credit with 5% phaseout at $200k for HoH and $400k for MFJ.Phases out at 5% above $150k of income for MFJ, $112.5 for HoH.Child tax credit (temporary changes for 2021 only):.Well, thanks to the $1.9B Coronavirus stimulus bill (#3), there are some pretty major changes to the tax code this year:

0 kommentar(er)

0 kommentar(er)